Techno Electric & Engineering company (TEEC) is a prominent Indian Power EPC (Engineering , Procurement andConstruction) player with a distinguished history of 4 decades.

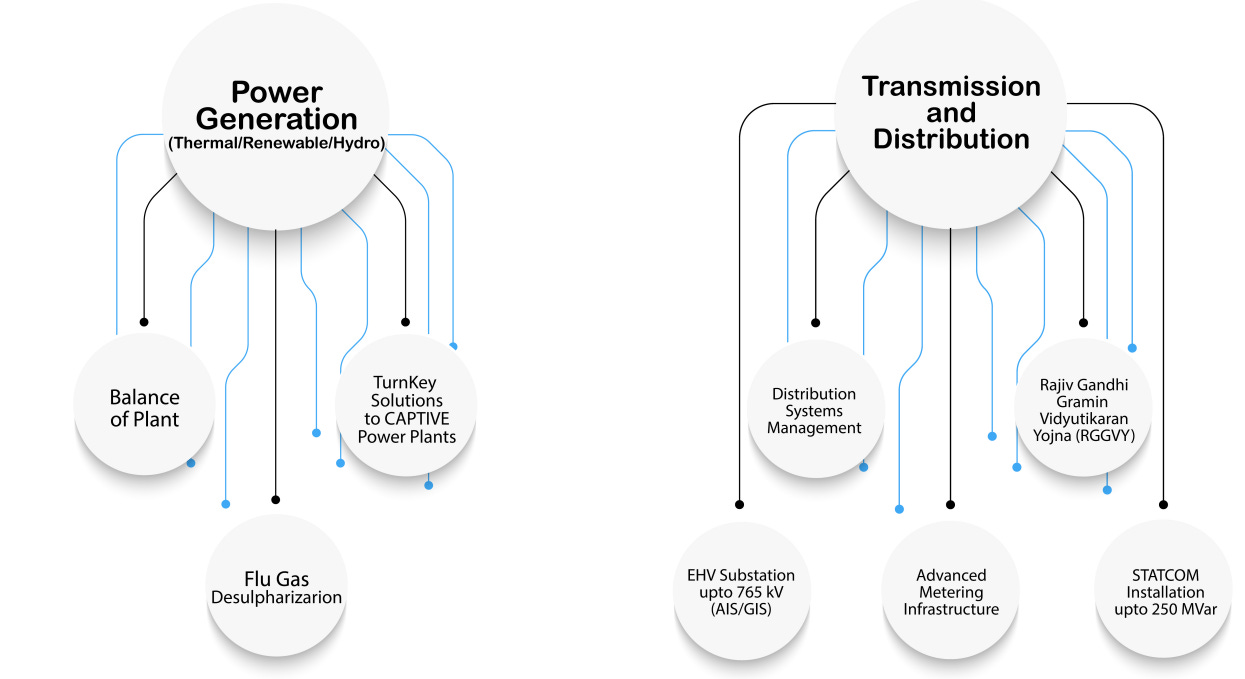

TEEC excels in executing EPC work for

Transmission & Distribution (EPC work for substations and distribution management systems)

Power Generation projects (Balance of Plant and FGD)

TEEC has recently expanded into rapidly growing segments like Advanced Smart Meters and Data Centres.

Major Domains of Operations

TEEC history is tightly interwoven with India's power sector evolution. TEEC were involved in establishing the first power station by NTPC. More than 50% of the substations operated by Power Grid Corporation of India have been built by TEEC. Recognizing the evolving landscape of the energy sector, TEECL diversified into transmission and renewable energy as asset owners.

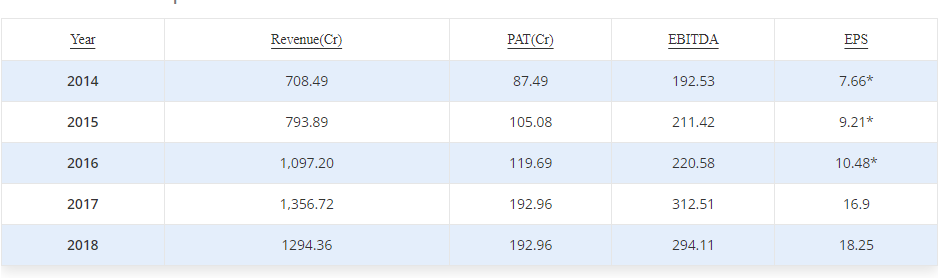

As the power sector evolved, so did TEEC. But 2011 to 2019 was a lull period for EPC players marked by Over capacity, less demand , debt concerns. But Techno electric stood out with profitable earnings, cashflows. Also, In 2019, Techno Electric did a buyback at 410/share.

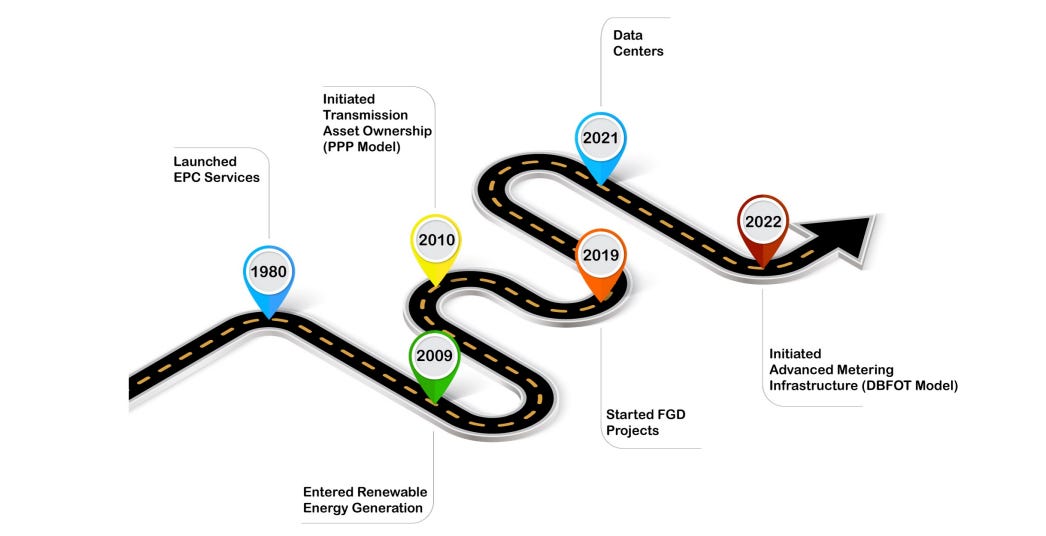

Since 2019, few other noteworthy business decisions were taken by TEEC. Look at this milestone map of TEEC. What insight did you gather?

Insight 1: TEEC differentiating factor - Ability to be FUTURE-READY

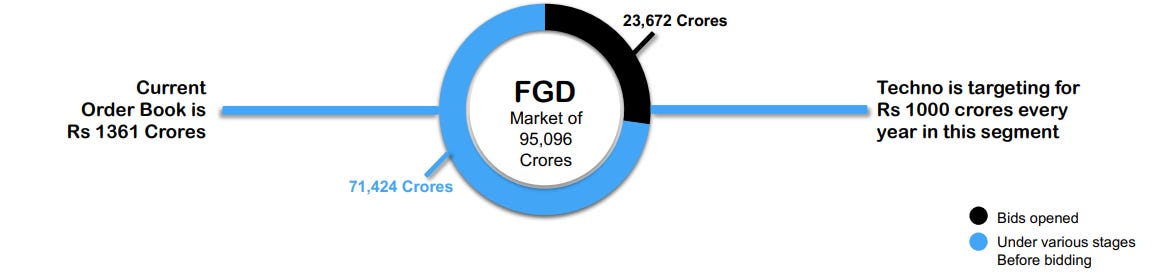

1. FGD

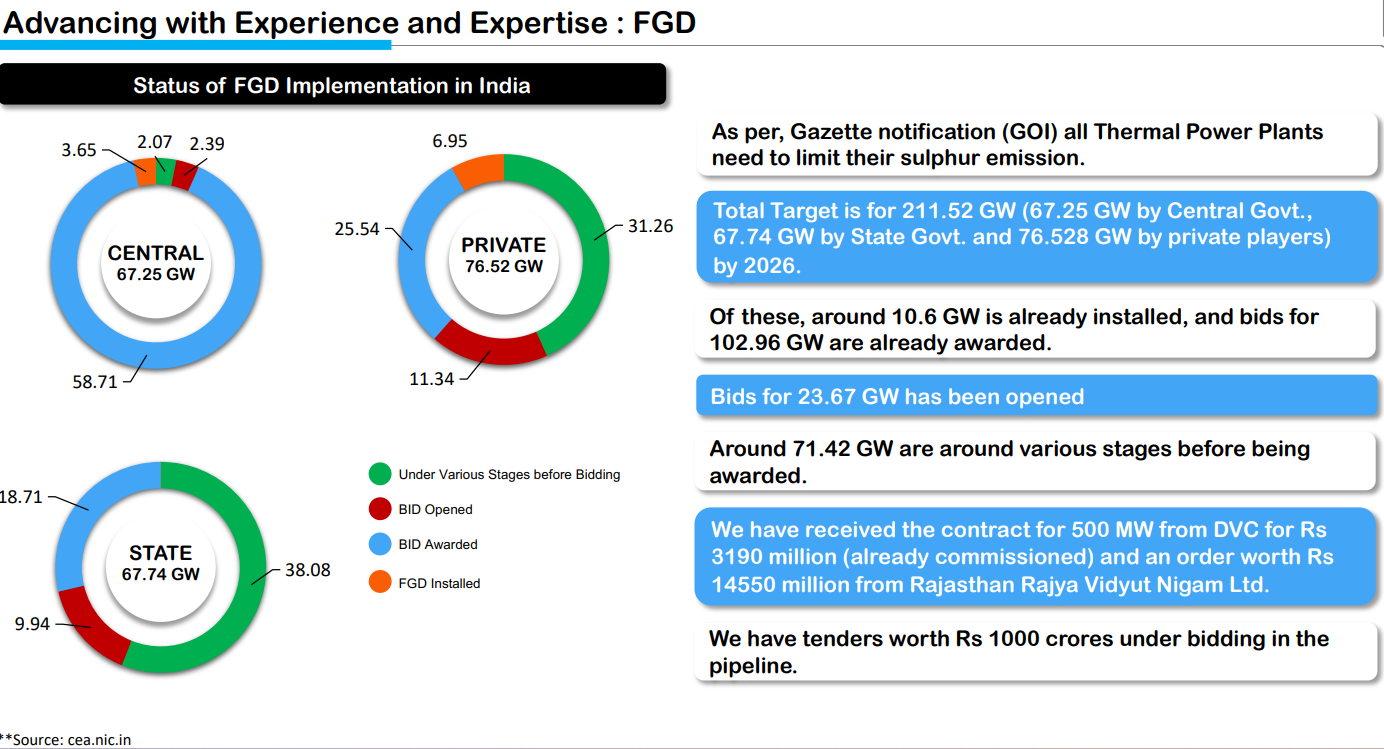

In 2019, TEEC started FGD projects.

Why FGD?

Flue-gas desulfurization (FGD) is a set of technologies used to remove sulfur dioxide from exhaust flue gases of fossil-fuel power plants.

Indian govt has strictly directed that the thermal power plants in India have to limit their sulphur emission to the prescribed levels. This will require the technological up-gradation of thermal power plants. Presently out of installed capacity of 230 GW of Thermal power plant in India, FGD has been ordered only for 50 GW and there is a big FGD market in India for 180 GW

Power plants may defer FGD CAPEX for next 2-3 years. So, this program of FGD will be steady over the next 10 years. TEEC already got business worth Rs. 40 Cr-50 Cr and TEEC expects to book business worth about Rs. 500 Cr in this segment year-on-year.

2. Data Centre

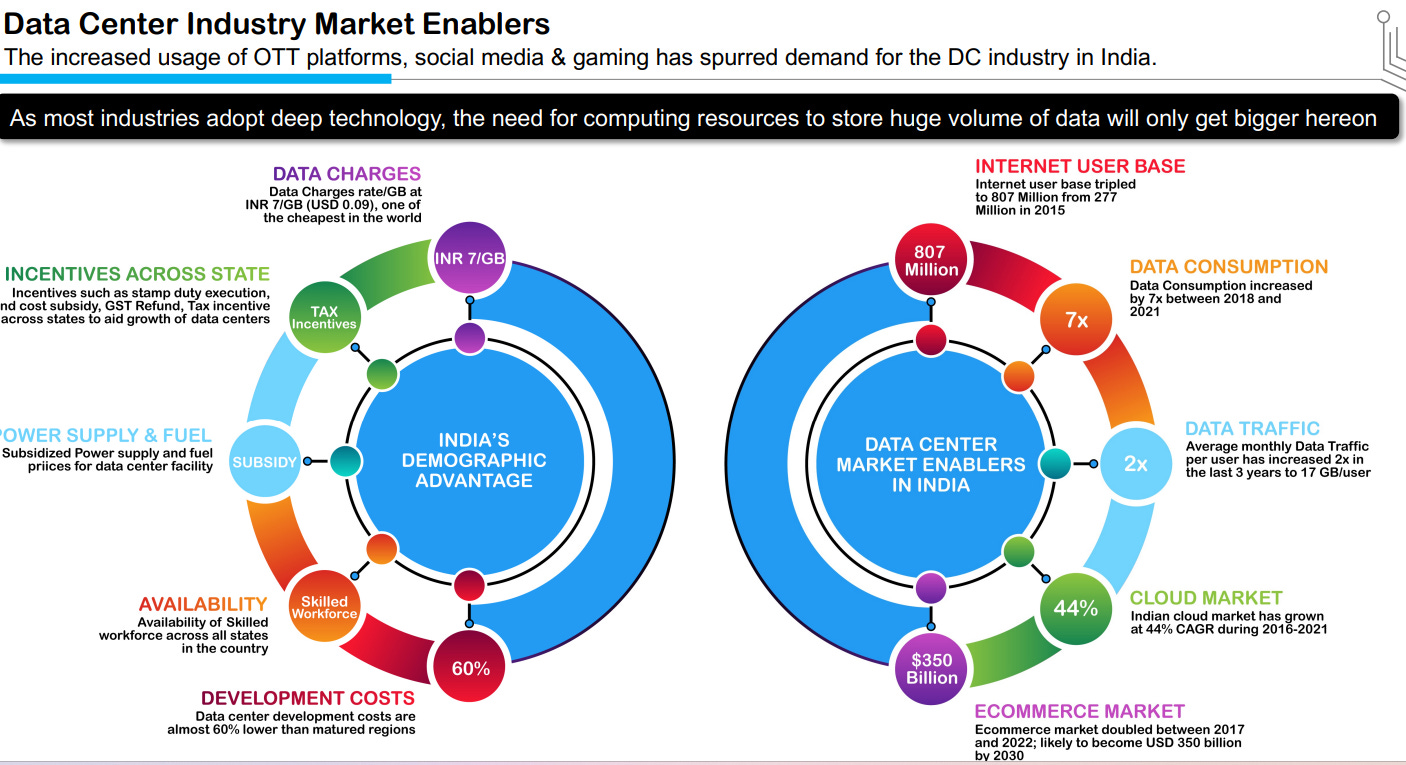

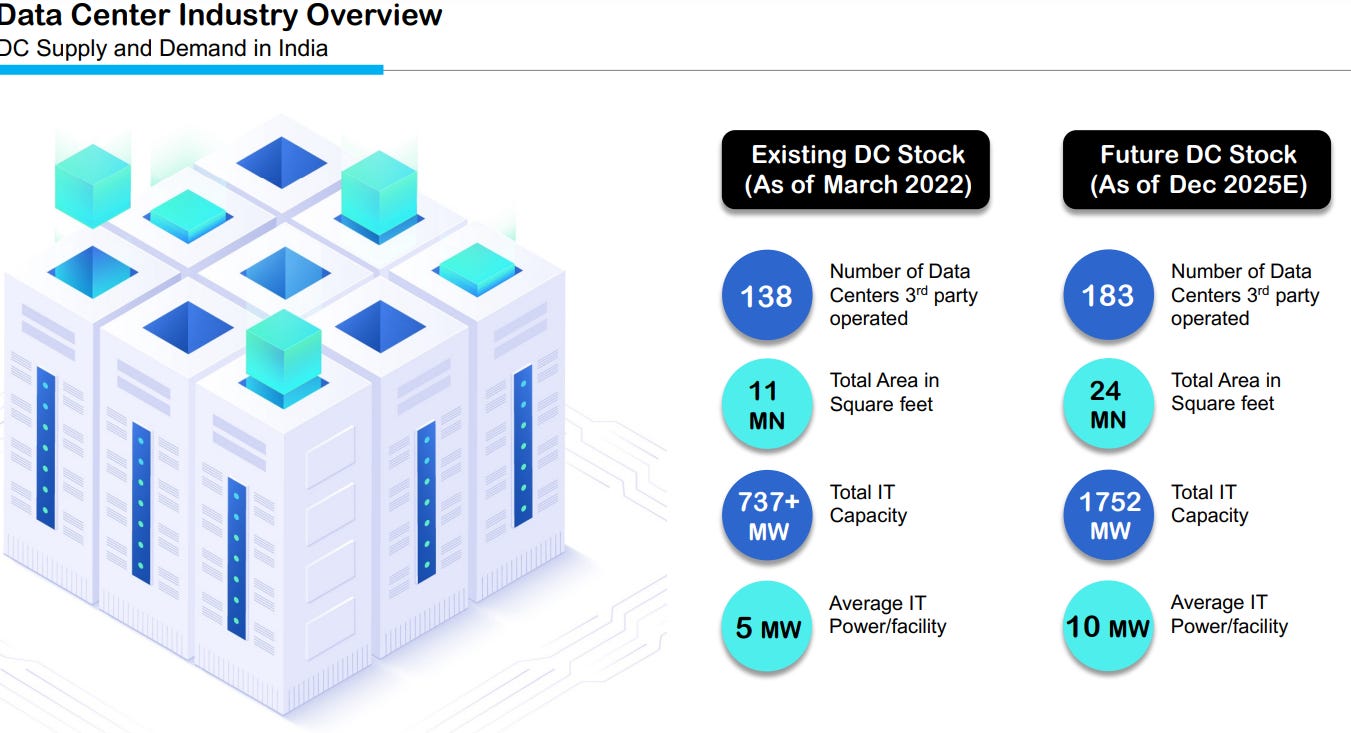

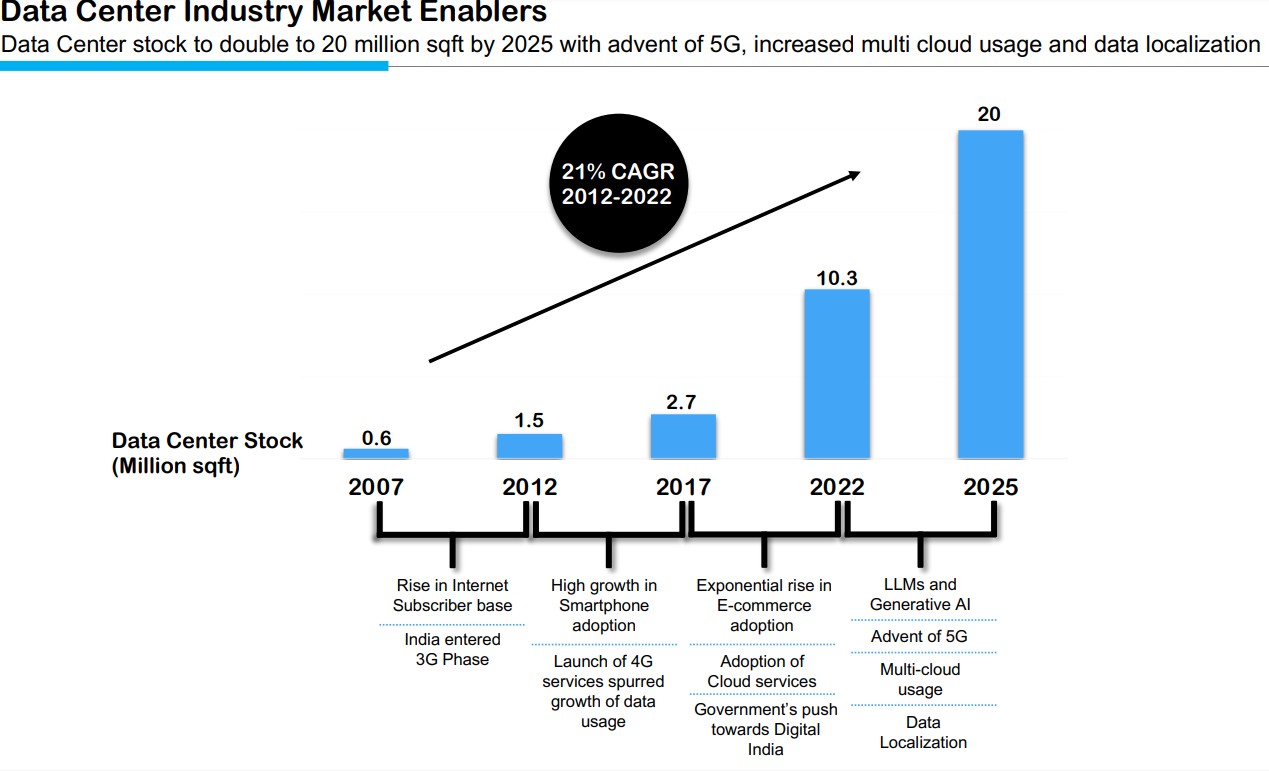

AI has given a big boost to the demand for Data centres. The growth driver is the public cloud adoption by the large entities and enterprise level and policy initiatives of the Government - the data localization, the data plan, the data protection bill 2023.

India data centre capacity to grow from 700 MW to 2GW by 26 and to 5GW by 2030. India actually offers a very attractive energy cost today apart from stability of supply when compared to Southeast Asia or Europe. So, most of the large operators would like to locate their data center in India providing a BIG opportunity for TEEC

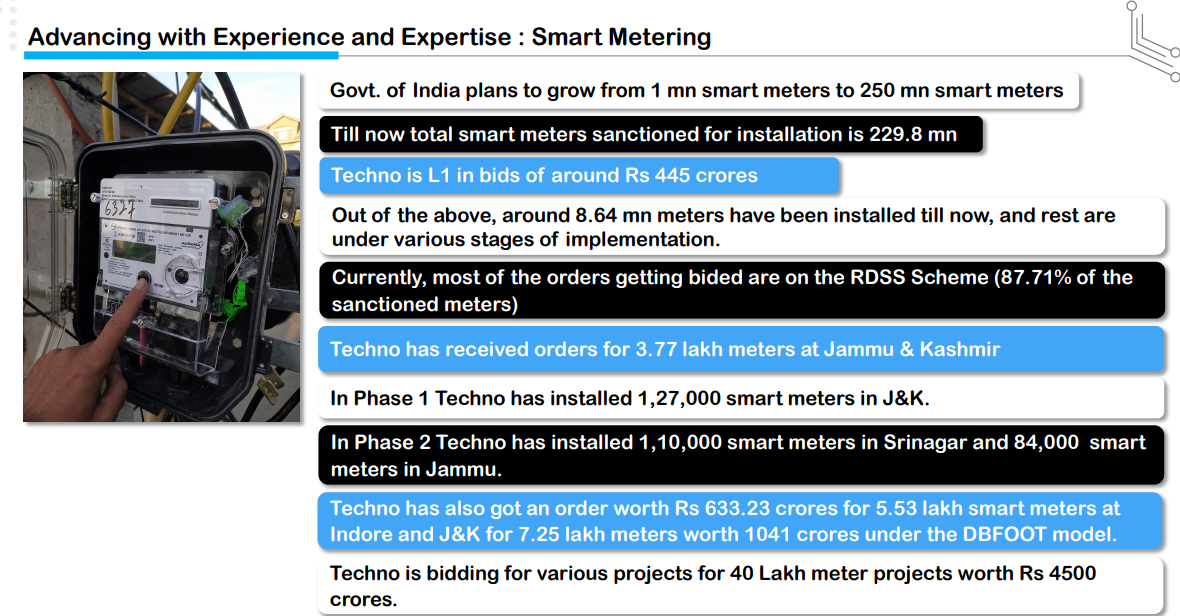

Smart Meters

In 2021, Government of India (GOI) launched the world’s largest smart metering or Advanced Metering Infrastructure (AMI) program to replace 250 million electricity meters with smart prepayment meters under the Revamped Distribution Sector Scheme (RDSS).

Under RDSS, GOI will provide 15% of the cost of the project as grant to the Discoms which will be passed on to the AMISPs (TEEC). TEEC will be paid on monthly basis for about 93 months after commissioning. TEEC has to adhere to maintenance norms including replacement of faulty meters, maintaining the last mile connectivity, IT systems upgrades as and when required.

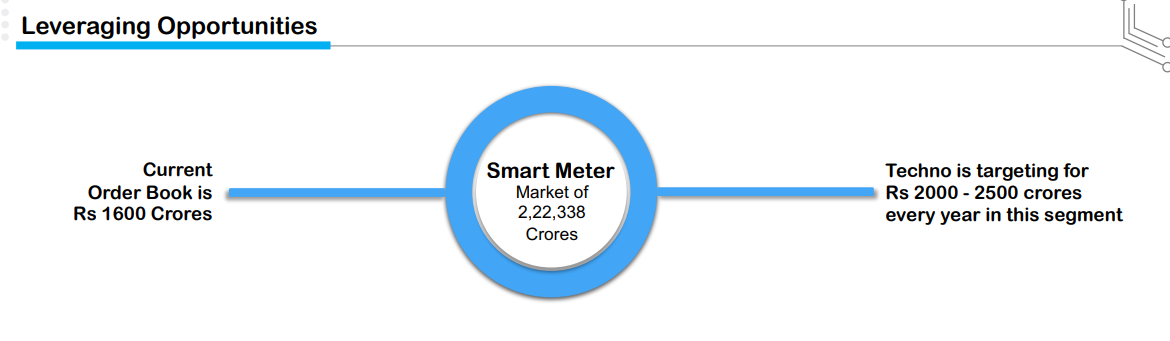

Under RDSS Scheme, Government has allocated 3 lakh crore to be spent over 5 years. So, the builds of about 100 million meters have happened and TEEC has bagged orders for about for 2 million meters and would like to build about two million meters per year over next 5 years, indicating market share of 5% in this segment

Why NOW?

Power Sector Capex in India is at its highest with a CAPEX of no less than 3.5 lakh crore in the next 9-10 years

Energy consumption is at all time high in the country today. By 2030, per capita consumption to reach 1750 to 2000 units as against 1250 now.India's power demand is expected to clock not less than 7% CAGR over a period of five years, which is at least presently touching around double digit of 10%.

Power Sector Tailwinds

The insatiable demand for power is leading to demand for all segments of power, power generation, power transmission, reforms in the power distribution, as well as business in the entire power value chain with power CAPEX being back.

Also, Indian govt has set an ambitious target of 500GW of renewable energy by 2030.

Is the Power sector capex benefiting Tehno Electric?

Insight2: Increasing Orderbook, exploding earnings

In the transmission sector, capex is back after a long gap. The total business in transmission may be around 40,000 crore per year, out of this station business can be taken other than HVDC to be around 7,000 Cr to 8,000 Cr and TEEC expects to have this business of 3,000 Cr year-on-year for next 3 years to 5 years

All Time High orderbook

For nine months, TEEC had a fresh order intake of almost Rs. 2,738 Cr and un-executed order book as on date now is all-time high at Rs. 5,441 Cr. Also TEEC also placed L1 in another business of almost about Rs. 1,700 Cr

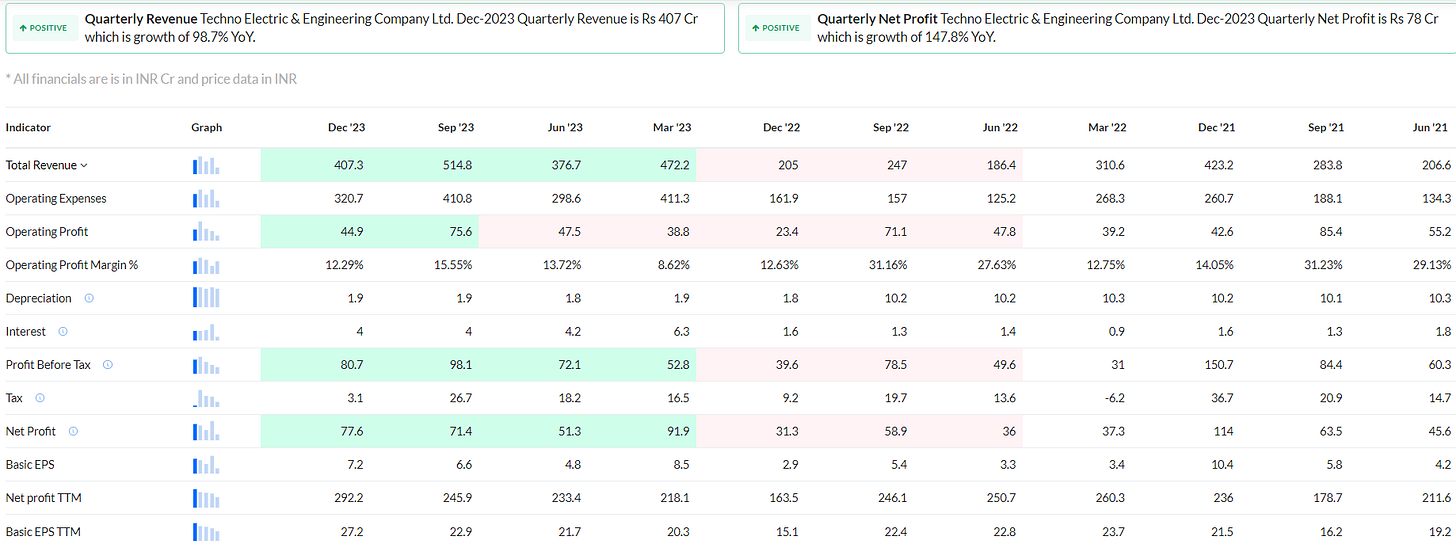

Exploding Earnings

The EPS of TEEC has been consistently hovering around 17 for many years and now onwards it is most likely to breakout above 20 .

The 9 month revenue is at Rs. 1,200 Cr, up 132% year-on-year.

The revenue for EPC is at Rs. 1,189 crores, up 134% up year-on-year.

EBITDA is at Rs. 168 Cr, that is almost double that of last year.

The operating profit for the EPC segment stands at Rs. 160 Cr, up 125% yoy

The operating profit margin continues to be at 13.69% for nine months.

EPC Players - New favourites of Investors

Few years ago, investors were hesitant to invest in EPC players. EPC was considered capital heavy business with high debt , low cashflow , delayed payments and hence premium valuations were not accorded to EPC players

With Infra/Energy boom the demand for quality EPC players has skyrocketed. Earnings concalls of of wind turbine manufacturers had indicated the need for quality EPC players to complete work on time and within expected budget. KP’s and Waare’s have become new EPC poster boys trading at rich valuations .

What makes TEEC a special EPC Player?

Insight3 : TEEC is Asset light , Debt free, Cash rich EPC Player

TEEC is not what an erstwhile EPC players was thought to be.

TEEC is Asset Light. How ?

Answer to this question gives an insight into how TEEC operates:

Techno Electric’s tried and tested strategy is to enter a new high growth sector , create high quality assets by leveraging its strength in executing EPC part of the work and then monetize the asset at an opportune time allowing it to build the war chest(capital) for future projects.

Meanwhile TEEC will continue to get EPC order flow from that particular business segment having established its credentials in that sector.

This is the reason why TEEC sold its transmission and Wind assets in the past. This also allows it to maintain EBITDA margin of 13% .

TEEC got into Data Centre business because 60-65% of the new data centre cost is into EPC Electro-mechanical works. TEEC aces at that and could build it cost effectively generating good 15-20% IRR and capital gains in future

TEEC is cash rich, generates cash flow and regularly pays dividend. The current investment values of cash and cash equivalent as of December end stand at around Rs. 1300 Cr. That is about Rs. 120 per share.

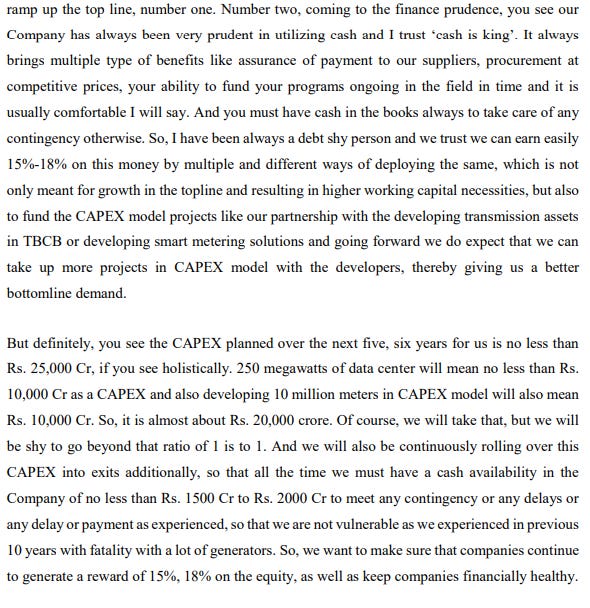

Insight4: Financially prudent , “Cash is King” EPC Player

TEEC has always been financially prudent and believes in ‘cash is king’.

How will an EPC player like TEEC cope up with unexpected contingencies ? Answer lies in their cash on books!!

TEEC foresees an annual capex of 2000 to 2500cr for next few years. To avoid any distress or delay, TEEC has seek permission to shareholders to raise funds through QIP or preferential . More details will be known as and when it happens.

Insight5: TEEC entering high growth phase

TEEC has run up a lot in the past few months. Does it leave anything on the table for new investors?

After a few difficult few years, TEEC is at an inflection point. TEEC expects the growth momentum to continue for the next few years.

Techno Electric have already perfected Rs. 400 Cr per quarter output for the last four quarters compared to Rs. 200 Cr to Rs. 225 Cr over previous years. From Q4FY24 onwards , TEEC expects a topline of Rs. 550 to Rs. 600 Cr quarter-on-quarter and which will further rise to Rs. 800 Cr in the year that it is in for the year 25-26.

Expected Topline

FY24 - Rs. 1,750 Cr to Rs. 1,800 Cr (includes 200cr for their own datacenter)

FY25 - Rs. 2,500 Cr

FY26 - Rs. 3,000 Cr to Rs. 3,200 Cr.

Valuations:

FY26 revenue of 3000cr-3200cr implies an EPS : 45/sh

At CMP 858, implies a forward PE of 19 . EPC players are trading at premium valuations, as TEEC delivers strong numbers PE rerating is a possibility

Data Centre:

TEEC has captured investors fancy because of its foray into data centre.

Techno is also in the advanced stage of setting up a data center of 24-MW IT load and 40 MW of grid load at Chennai, which has achieved significant progress over the last one year and the first phase should be ready anytime now

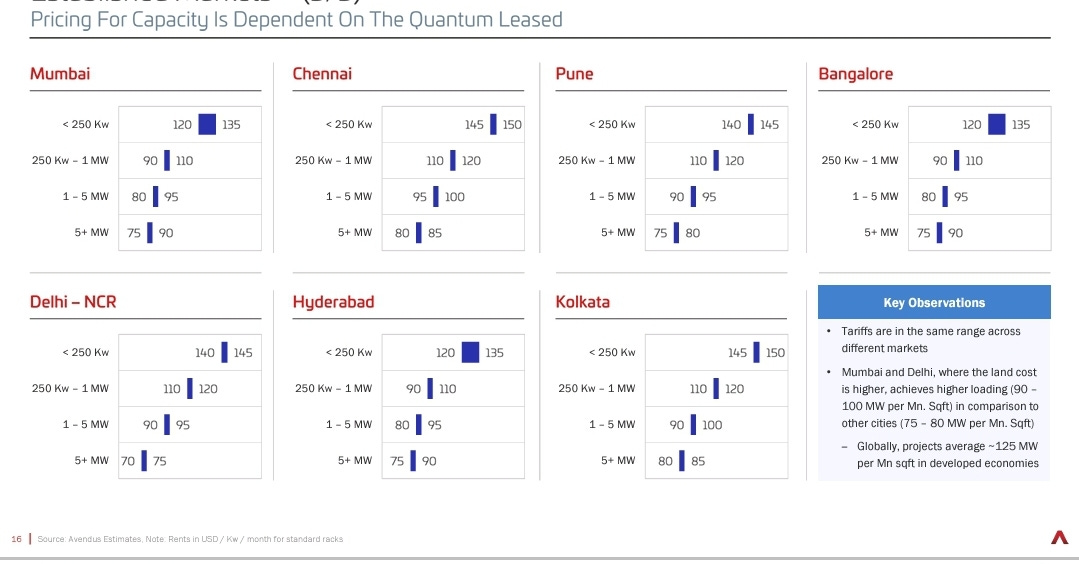

The CAPEX for Chennai data centre is expected to be around Rs. 1400 Cr that is no more than Rs. 45Cr per MW and with 60% of CAPEX happening in the electro-mechanical works. Estimated rent per MW per month is 80-90Lakhs

Revenue recognition from data centers to start making a significant impact from FY26 . Techno Electric will find a suitable partner for its data center assets . Initially it might monetise investment cost by selling a part of the stake. Management is yet to decide whether some part of the Data centre would be reserved for monthly rentals.

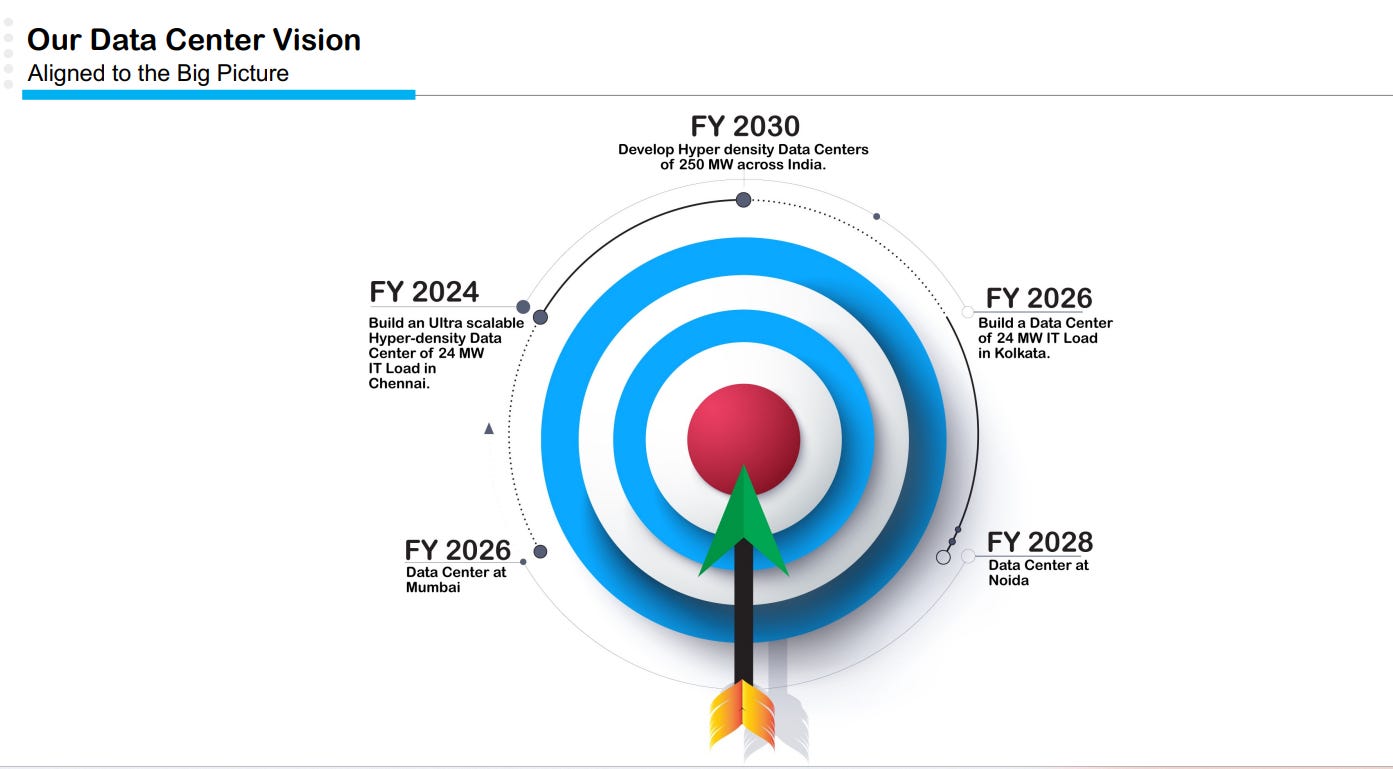

Vision 2030 - TEEC to have Hyper Density Data centers of 250MW across India

RISKS:

Delay in execution or receiving payments

Any environmental calamity or other events affecting the prpoerty or the construction

Any decrease in expected IRR of 15-20% in Data centers or 13% EBITDA in EPC will affect earning estimates

Conclusion

Sector Tailwinds, Earnings Momentum, Growth Triggers, Expansion into high growth businesses are favouring TEEC to post lifetime best earnings for the next few years.

Will the POWER player get more POWERFUL??

Very creative information about the business

Great stuff.. Keep 'em coming.. Kudos.