WTiCabs - Are you ready for a profitable ride?

Profitable, consistent, fast-growing B2B mobility player

Covid struck in March 2020. The whole world was under lockdown , with people being restricted to remain within the walls of their house. In the middle of this chaos, a new HAPPY trend emerged for a section of employees - WFH : Work From Home.

One main reason why employees love WFH is their hate towards commuting to work.

Especially IT/ITES employees welcomed WFH culture and still praying that the WFH culture never goes away. But things have changed post covid.

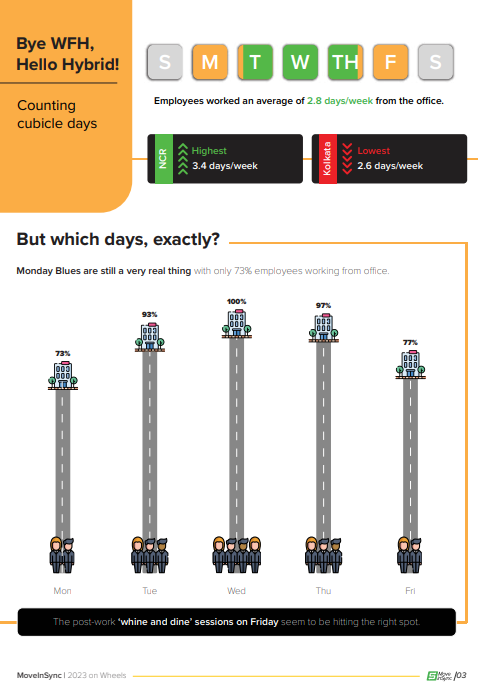

WFH has given rise to a new “Hybrid Work“ model. But one announcement from TCS shattered dreams of many remote workers

Tata Consultancy Services (TCS) has linked quarterly variable pay to office attendance, and employees with less than 60% attendance are not eligible for the quarterly bonus.

It means “Work from Office” is back.

Now put your investor hat 🎩 on and think who will benefit from this.

Hint: To work from office , one has to first travel to office!!

If you still didn’t get, don’t worry!! I started searching for a company which provides Employee Transportation Services?

Bingo, I found one. It listed very recently on 19 Feb 2024. Here is your profitable ride :

🚖WTICabs

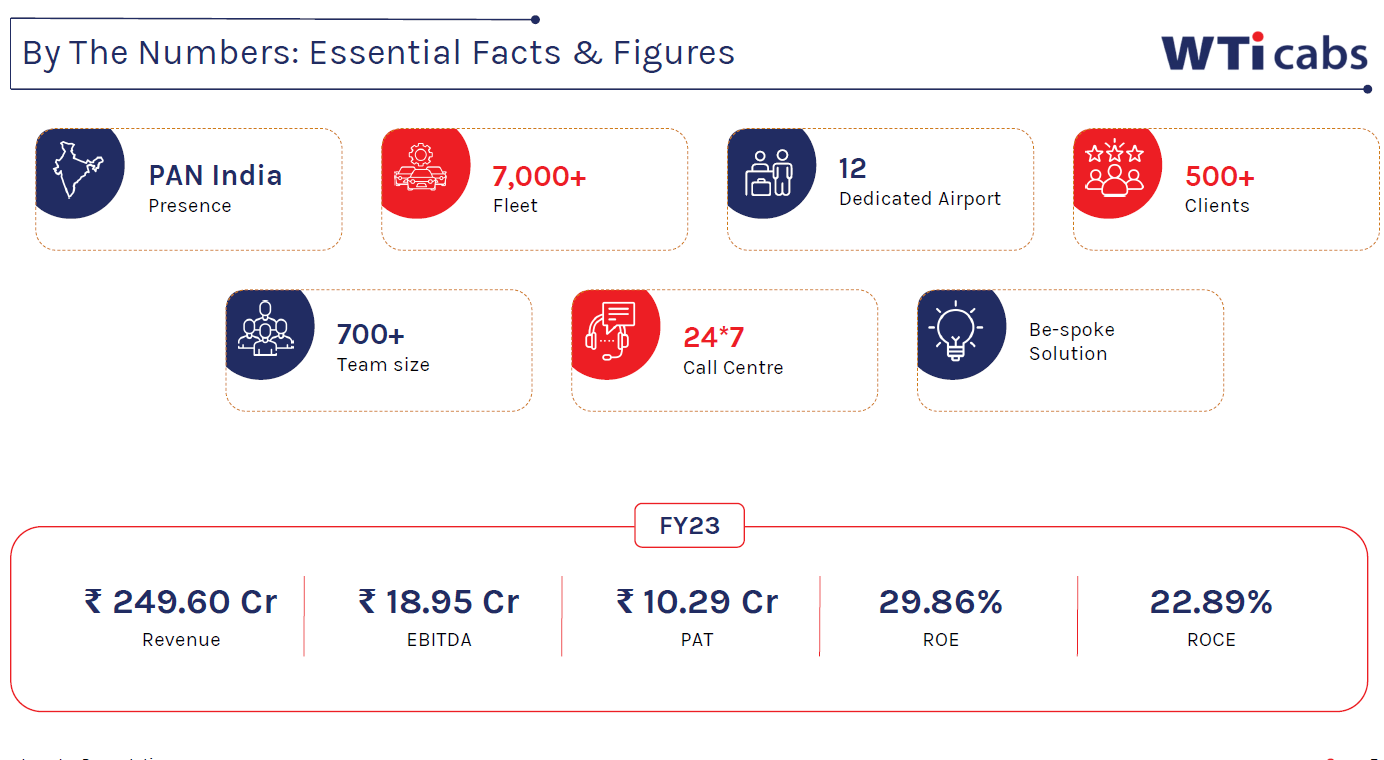

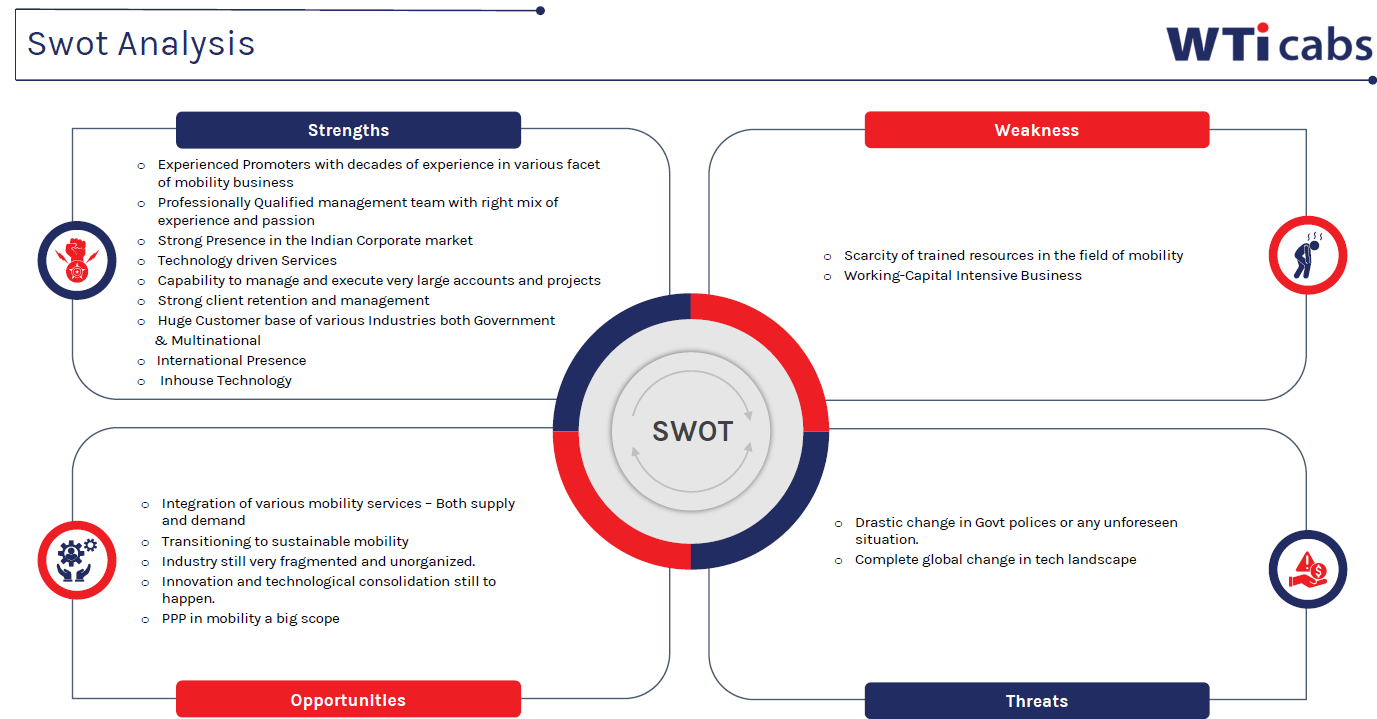

WTiCabs is one of the profitable, consistent, fast-growing B2B-focused corporate commute and people transportation services provider.

WTiCabs offers a range of cab services including point-to-point transfers, airport transfers, outstation travel, and employee transportation. Additionally, they provide fleet management software tailored for taxi operators. They standout in B2B offerings through customized, tech-enabled, end-to-end mobility solutions designed to scale with the needs of the business.

Segment wise services:

CRD (Car Rental Direct or Spot Rental) : Car Rental Services – providing chauffeur driven cabs serving car rentals needs

ETS (Employee Transportation services) : SLA-based, bespoke Mobility Solutions for the corporate daily (Home-Office-Home) pickup & drop services for their employees

MSP (Managed Service Provider): An End-to-End Employee Transport comprehensive solution to make employee transport management operations automated, efficient, safe and transparent

Projects Long term Rentals : Long Term mobility management contracts with Govt, ports and other organisations where some special training is required for the drivers

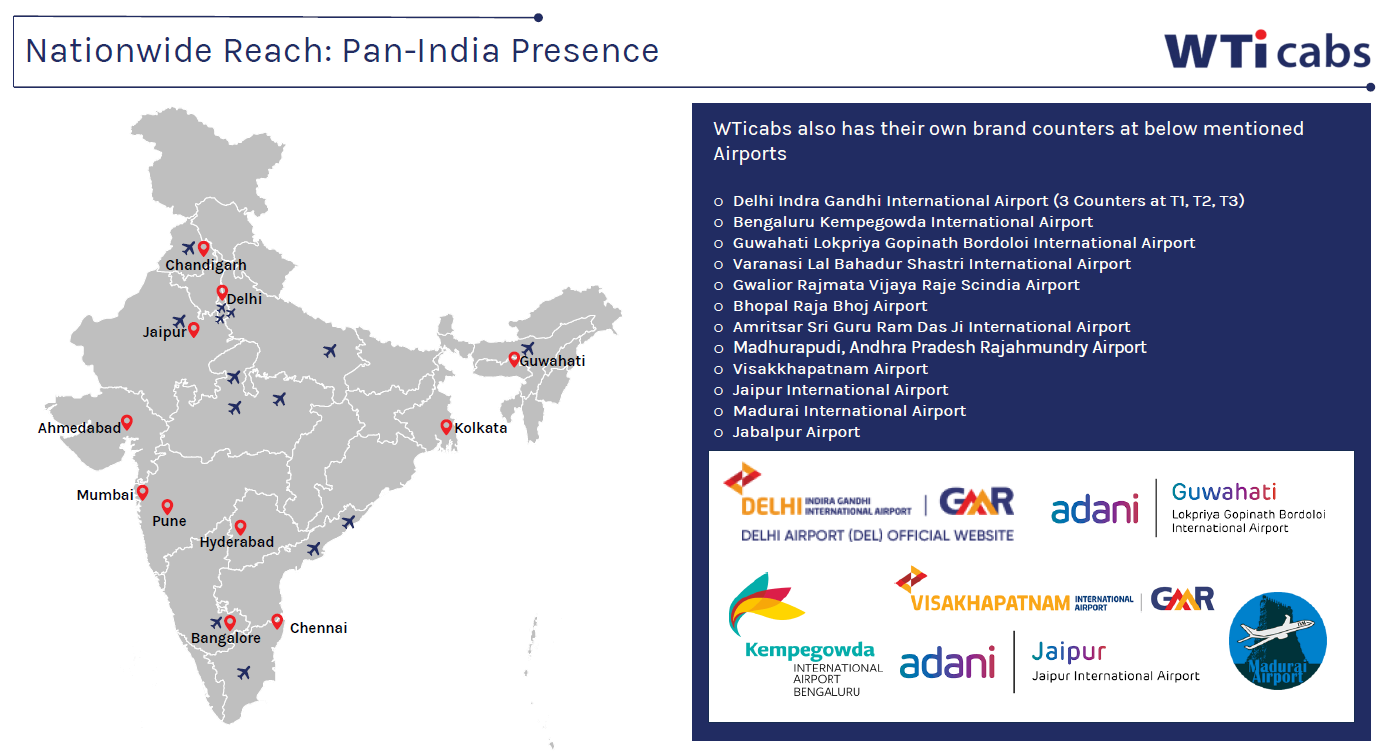

Airport Counters : Transportation services offerings at 17 ports across India

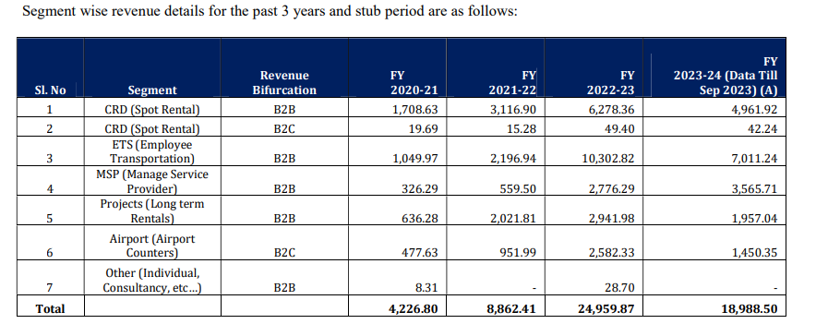

Segment wise revenue details for the past 3 years and stub period are as follows:

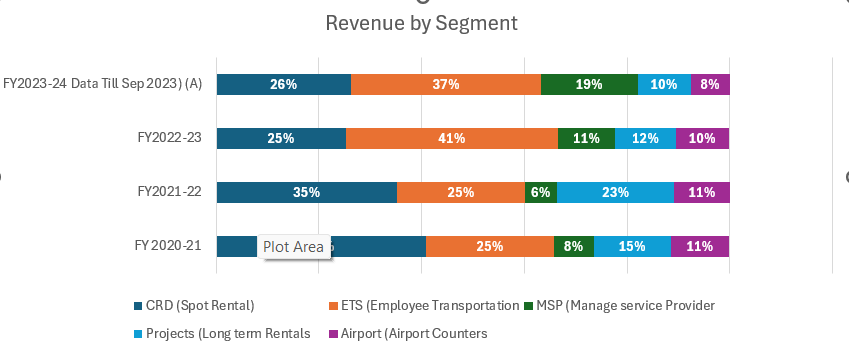

Insight1: 85% of revenues from B2B - More Predictable , Profitable

Ola, Uber are mainly B2C cab aggregators, whereas WTICabs geenrates major part of revenue from B2B.

Revenue from Corporate commute contracts are predictable and recurring in nature

Less marketing spend

Cients once acquired tend to be sticky. Room for growth

Right to Win??

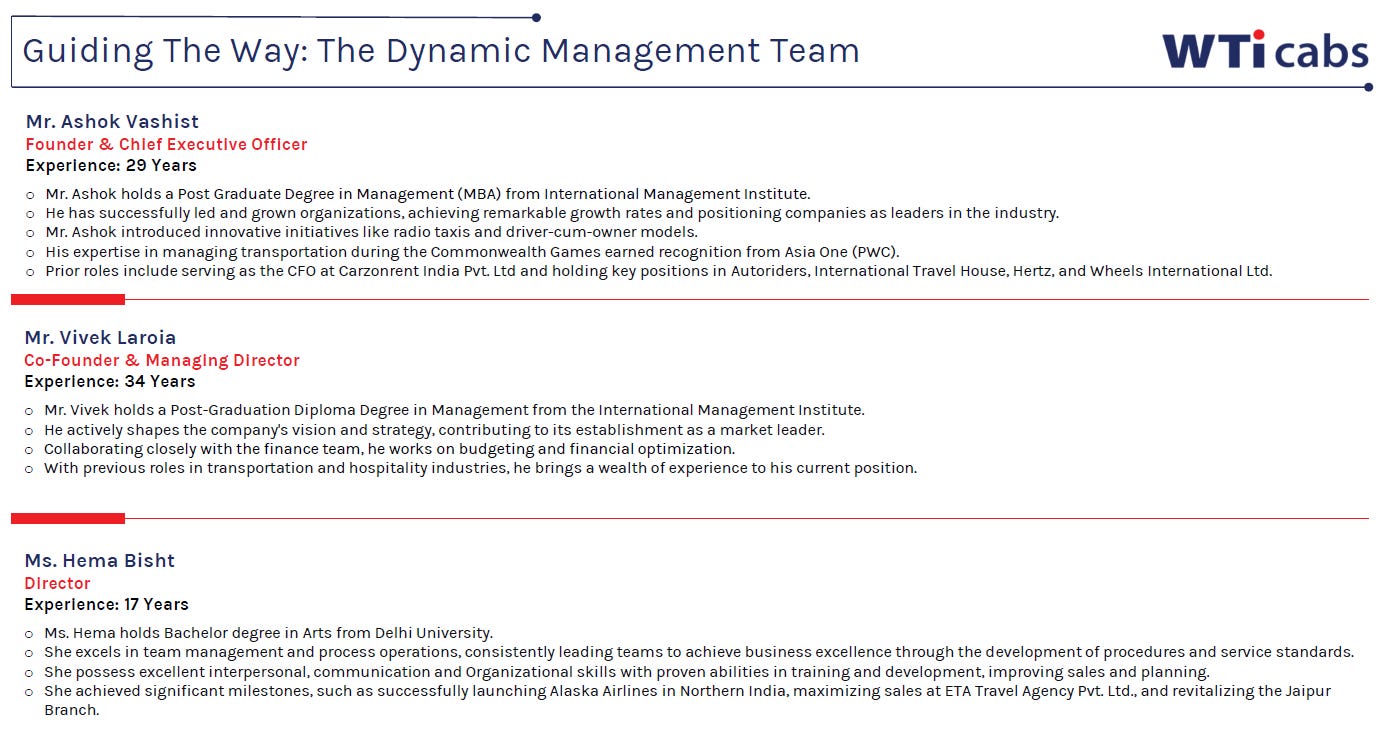

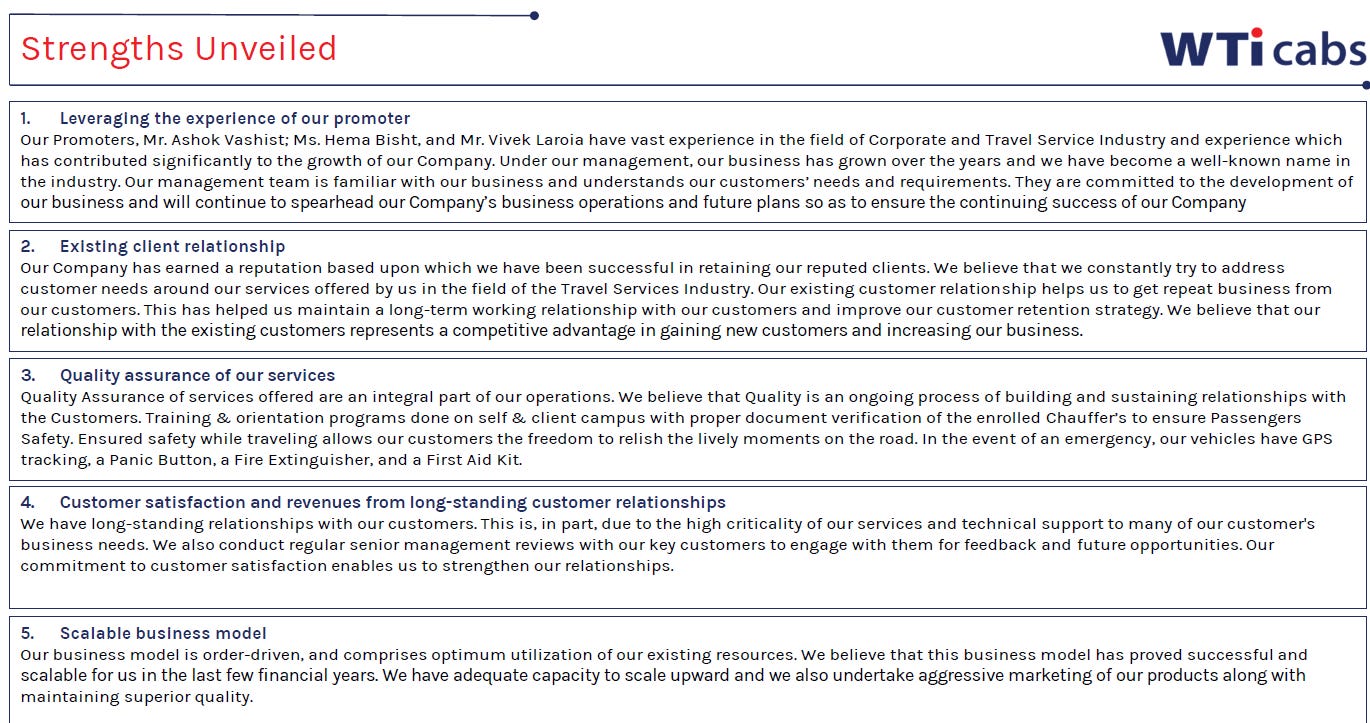

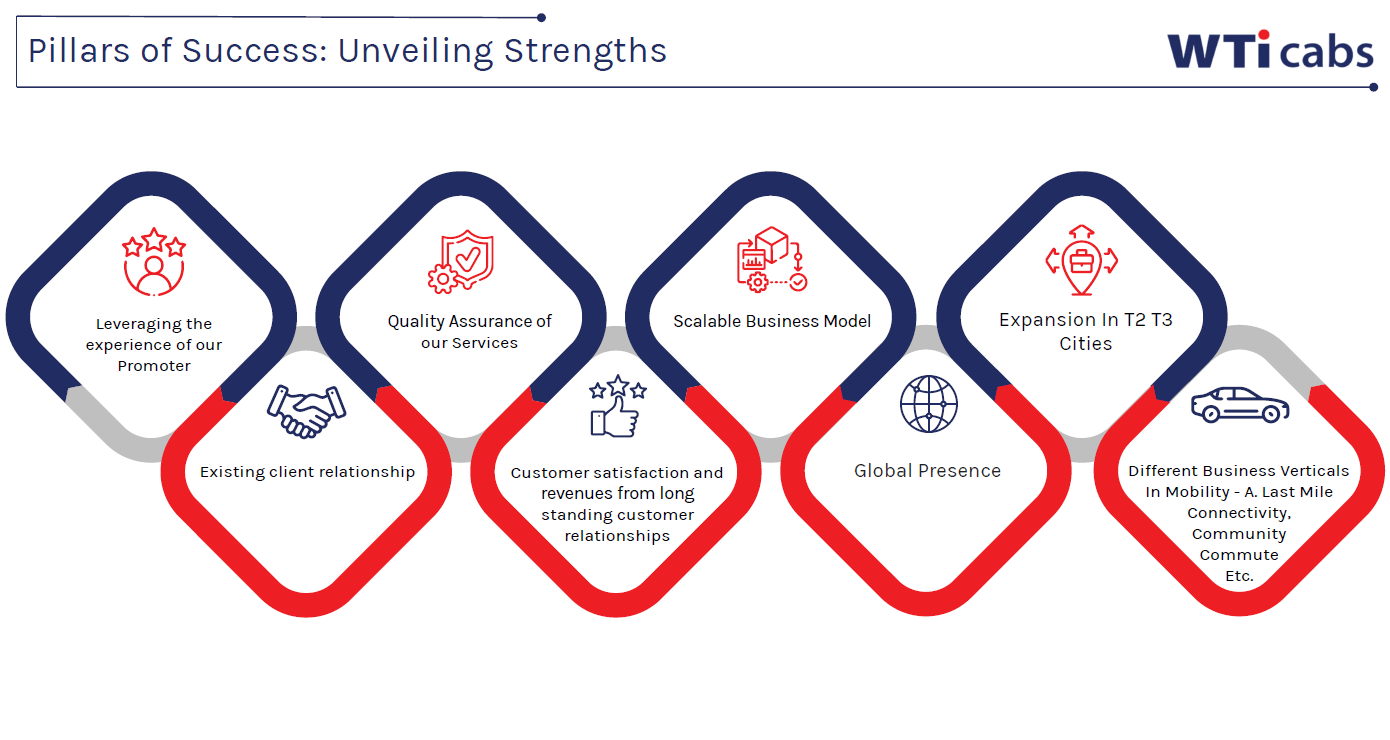

What gives the Right to Win for WTiCabs - Promoter Experience and Expertise

Insight2: Promoter Experience and Expertise

Mr. Ashok Vashist, the CEO & Founder of WTiCabs

Ashok Vashist's career in mobility spans over three decades, beginning with a role in TCI in 1994 followed by prominent roles in major car rental firms and pioneering the first radio taxi service, Easy Cabs, in India. He is into transportation business all his life and his expertise , experience has stood the test of time bringing great success to WTicabs

His transition to entrepreneurship was driven by a vision to innovate within the mobility sector. He took a plunge in 2009, launched WTiCabs .

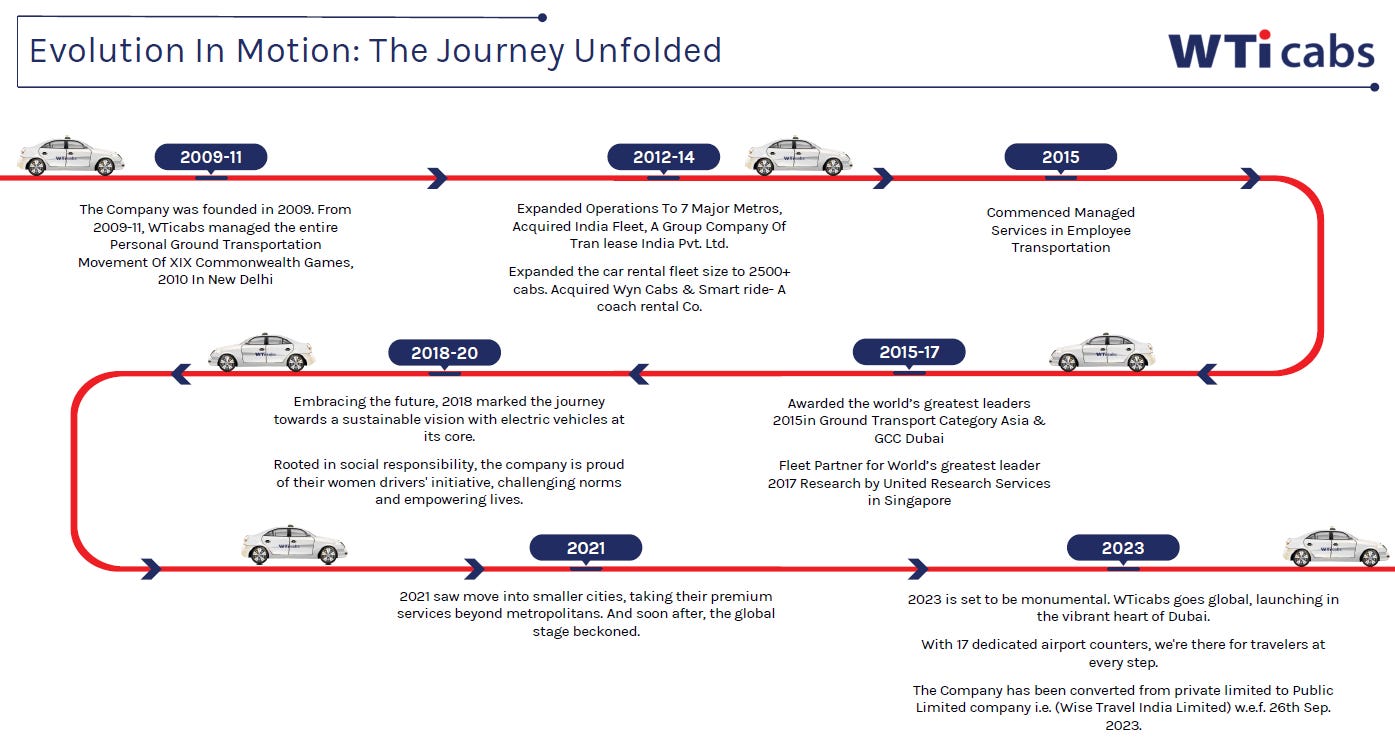

Starting with a completely bootstrapped model, WTi has grown exponentially, achieving a compounded annual growth rate (CAGR) of 30-35% until the COVID-19 pandemic hit. Despite facing significant challenges during the pandemic, with revenues plummeting, WTI made a remarkable recovery in the following years, closing FY24 with a revenue of INR 400 crore.

Insight3: Operational Excellence - Bootstrapped , profitable and 35% CAGR growth

In an era of Ola, Uber raising millions of dollars and yet struggling to remain consistently profitable , WTicabs stands apart as a completely Bootstrapped (WOW!!) company. It shows the operational and financial prudence of the co.

It also showcases the skin in the game of the promoters. WTiCabs made acquisitions in 2012 to expand fleet to 2500+, one of the first to pioneer the concept of Managed services provider for corporates in 2015, expanded to Tier 2 , Tier 3 cities in 2021 and in 2023 going international.

Post covid growth has picked up in Tier2 , 3 cities and the management has picked the trends timely throughout their journey resulting in a steady profitable growth. This gives confidence in their ability to maintain growth and win in global market as well

Their distinguished approach involves deeply analysing commuting patterns and organisational DNA to design customised transport programmes, ensuring efficient asset utilisation and cost-effectiveness. This strategic focus on service delivery and client satisfaction sets WTI apart in a crowded marketplace.

Why NOW?

🚖 Insight4: The best is yet to Arrive

Remember , we talked about work from office is back ?? Now is the time to check the thesis

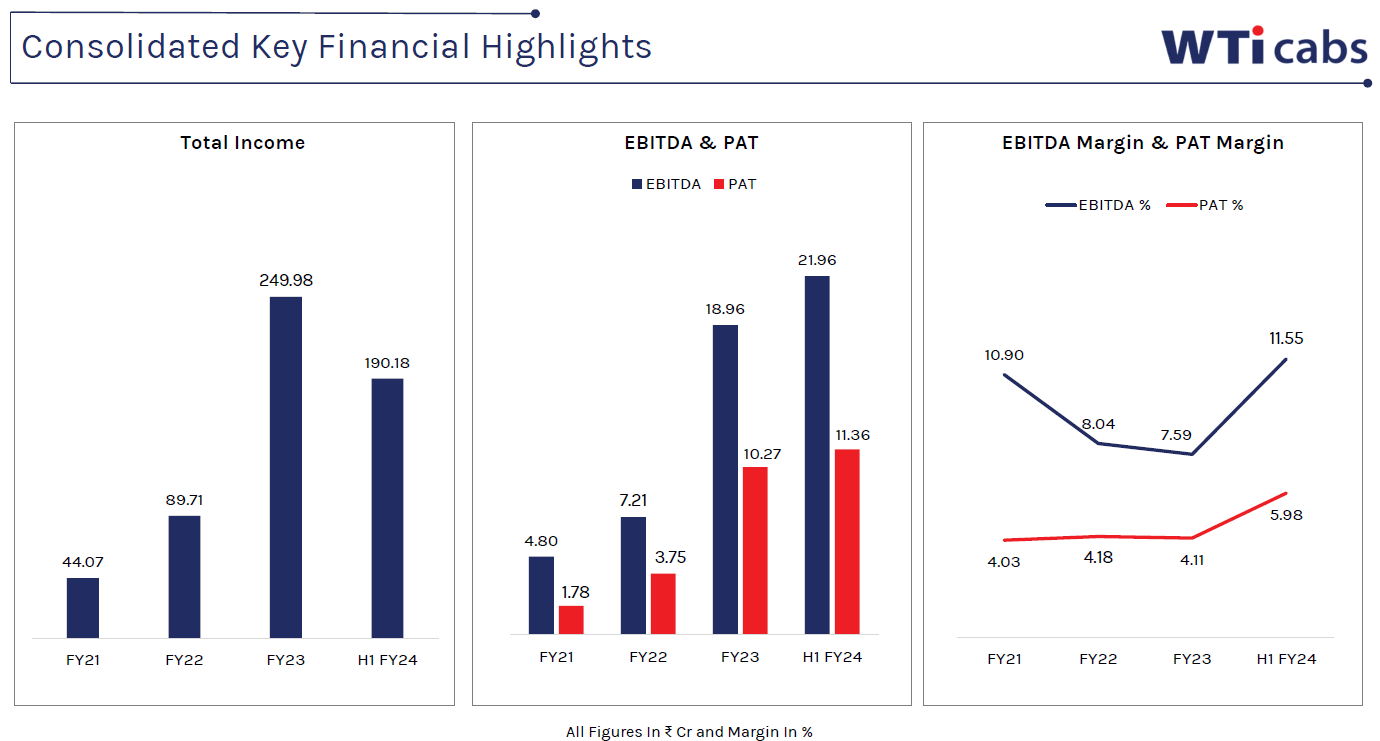

FY21 , FY22 were washout years because of Covid and WFH.

FY23 was the first year after covid where most of the operations were back. WTiCabs clocked 250cr revenue

In the first half of FY24, it has clocked a revenue of 190cr. Around 80% of the FY23 revenue is already booked in the half of FY24 which indicates the demand is back. Since the business is not seasonal , management expects to hit a revenue of 400cr in FY24.

Valuation:

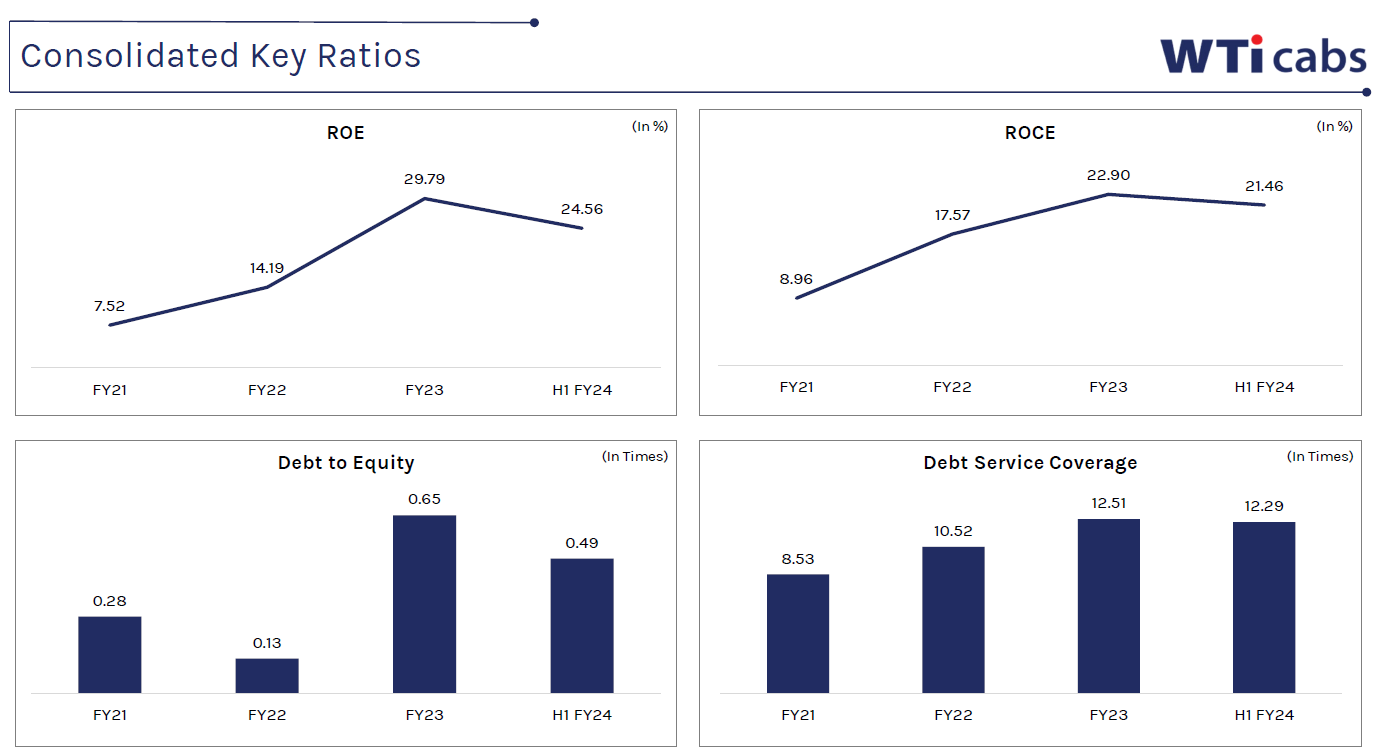

At CMP of 218, WTiCabs is at a market cap of 521cr implying a MarketCap to sales of 1.3 which looks undervalued. I would give it 3X Mcap to sales

Half year EPS ~6 , extrapolating to full year estimated EPS is 12.

Shree OSFM E-Mobility Ltd is into the same business as WTiCabs and its a listed peer. It is trading at PE of 48.5 and MCap to sales of 1.83.

WTiCabs is undervalued despite having more scale and better return ratios than its peer. WTiCabs expects to maintain EBITDA margin of 11-13 and PAT margin of 6%.

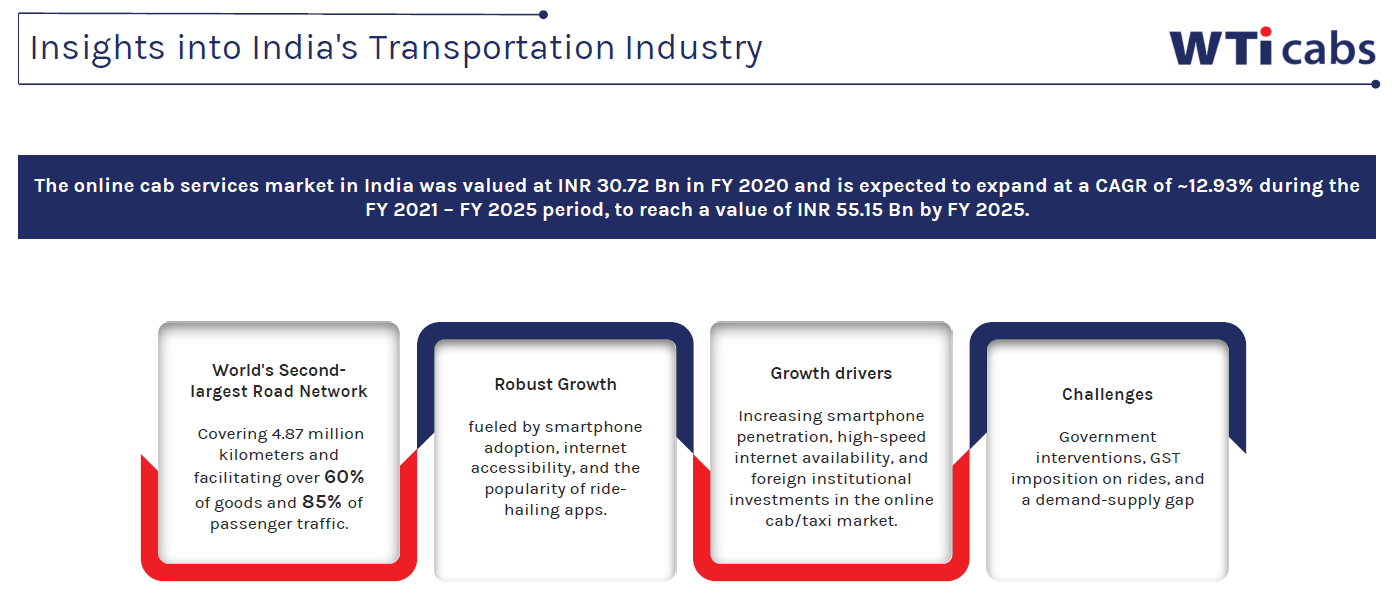

Insight5: Huge TAM , opportunity size , 30% compounding growth story

TAM, sectoral tailwinds are huge .

WTiCabs foray into International markets starting with Dubai, Saudi Arabia and expanding to far-east countries further strengthens the growth potential . Management expects growth of atleast 30% for the next few years.

Only 17% of workforce in India is Women today. Govt and corporates are trying their best to increase the participation of women in the workforce. The first big need for woman to join workforce is a secure, safe way to commute to workforce . This results in a big oportunity for B2B commute providers like WTiCabs

Concern1: Higher receivables , capital intensive operations

Details of Use of Issue Proceeds: 1. The Business of the Company is working capital intensive; hence it will meet the requirement to the extent of ₹ 73cr from the Net Proceeds of the Issue and balance from borrowings at an appropriate time as per the requirements of the business. The Company will be utilizing the additional working capital for expansion of its business activities.

TRADE PAYABLES: The Company have actively worked towards streamlining the payment cycle to its creditors, with the goal of ensuring better relations with the fleet operators.

In FY 21, the payment cycle stood at 207 days, which was subsequently reduced to 122 days in FY 22. This led to substantial jump in revenue from INR 8862 Lakhs to INR 24959 Lakhs as most of the operators are small time and not able to pay the vendors as debtor days stay around 90 days. Creditor days was further reduced to 80 days in FY 23 which led to H1FY24 revenue of INR 18988 Lakhs (~52% increase on annualized basis). The payment cycle averaged 55 days. This actually helps WTiCabs to gain market share over small players acting as entry barrier to small ones.

Insight6: Better payment cycle to vendors is a major reason for WTiCab’s revenue growth

If you have taken an Ola before, do you remember drivers requesting to pay in cash as Ola pays them weekly?? Applying the same concept, if WTicabs pays their fleet operator in 30 days , it will give them an upper hand over its competitors and small players

Since, most of fleet operators are small time entrepreneurs and are not able to provide similar credit cycle like WTI reducing payment cycle would help WTI gain market share. As per Company’s discussion with its vendors in order to achieve incremental growth targets WTI would need to substantially reduce its credit cycle. Reduction in credit cycle is the reason why most of the operators are not able to scale. Looking ahead, the company is planning to implement a more accelerated payment cycle, with the aim of reducing credit cycle days to 30 days.

Concern2: Higher trade receivables

Reason for higher TRADE RECEIVABLES: The Company gives credit period to its clients so as to increase its business with them and the company has given a credit of 115 days in FY 21 which remained unchanged for FY 22 at 115 days. However, it was reduced to 87 days in FY 23 with a focus on optimizing the credit management processes. During the stub period 30.09.2023 the credit given to clients averaged at 75 days.

The company is planning to give more credit to the clients so as to increase the overall revenue of the company and is projecting a credit period of 90 days for FY 24. It is Industry norms to have credit cycle of 90 days for receivables and going forward same range is expected.

Concern3: Mining subsidiary

PT. WTI Trading & Mining Ventures (Indonesia) was incorporated on January 14, 2020 with a mining business as main objects of the Company. Due to lockdown and other restrictions, business was not paced as planned by the Management of the Company.

Management will not pursue this business anymore.

Concern4: Associate company in he same line of business

Aaveg Management Services Pvt Ltd as mentioned in the RHP, is almost in the same line of business as WTiCabs. It has significant operations with Revenue of 36.35 crores in FY23 and 16.53 crores in FY22

Management clarification on this issue: Aaveg was formed for GST related issues. Basically, it was due to RCM reason.

Now, consolidated services are being given by WTI itself. The payments were made to Aaveg as if someone is having an agreement with Aaveg, then those service continued to be in Aaveg and WTI were fulfilling these services and vice-versa

Concern5: EV Fleet is small

EV fleet helps companies to meet their ESG sustainability goals and is one of the primary drivers for corporate to opt for EV fleet.

Currently WTiCabs has a fleet of 7000cars. EV is only 300.To address these concerns, WTicabs plans to induct 1,000 EVs in its fleet this fiscal.

Conclusion:

WTiCabs - It has the edge of the expertise of its promoters, a huge opportunity size for growth, and untapped market in Tier2 cities and International markets . Above all it is providing a good value at these valuations.

I haven't researched much on it. If I see tailwinds benefitting few companies will cover it

Bhai.. Kya likhte ho aap! Fan. 😇